Featured

Table of Contents

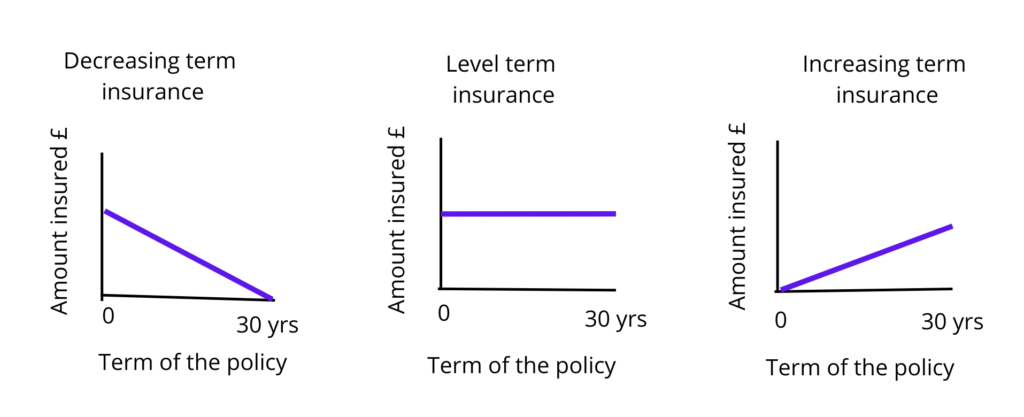

A level term life insurance policy can offer you comfort that individuals who depend upon you will certainly have a survivor benefit during the years that you are planning to support them. It's a method to aid deal with them in the future, today. A degree term life insurance policy (occasionally called level premium term life insurance) policy supplies protection for a set number of years (e.g., 10 or twenty years) while maintaining the premium repayments the same throughout of the policy.

With degree term insurance coverage, the price of the insurance policy will stay the very same (or possibly decrease if returns are paid) over the regard to your plan, typically 10 or 20 years. Unlike long-term life insurance policy, which never ever ends as long as you pay costs, a degree term life insurance plan will certainly end eventually in the future, typically at the end of the duration of your level term.

What is Term Life Insurance For Couples and Why Choose It?

As a result of this, many people make use of permanent insurance as a secure economic planning device that can offer numerous demands. You might be able to transform some, or all, of your term insurance policy during a set duration, commonly the first ten years of your policy, without requiring to re-qualify for protection even if your health and wellness has altered.

As it does, you might desire to add to your insurance coverage in the future - term life insurance for seniors. As this occurs, you may desire to eventually reduce your fatality advantage or take into consideration converting your term insurance coverage to a permanent policy.

So long as you pay your premiums, you can rest very easy recognizing that your loved ones will obtain a survivor benefit if you die during the term. Lots of term policies allow you the capacity to convert to permanent insurance coverage without needing to take one more health exam. This can enable you to capitalize on the fringe benefits of a long-term policy.

Level term life insurance coverage is just one of the easiest paths right into life insurance coverage, we'll talk about the benefits and downsides to ensure that you can choose a plan to fit your demands. Degree term life insurance policy is one of the most usual and standard type of term life. When you're seeking short-term life insurance policy plans, degree term life insurance policy is one course that you can go.

You'll fill up out an application that contains general individual details such as your name, age, etc as well as a more detailed set of questions regarding your medical history.

The short response is no., for instance, let you have the convenience of death benefits and can accrue cash value over time, implying you'll have more control over your benefits while you're to life.

What is Term Life Insurance For Spouse? Explained Simply

Bikers are optional provisions added to your plan that can give you extra advantages and defenses. Anything can occur over the training course of your life insurance coverage term, and you desire to be prepared for anything.

This cyclist supplies term life insurance on your kids via the ages of 18-25. There are circumstances where these benefits are developed right into your policy, however they can likewise be offered as a different enhancement that calls for extra repayment. This rider offers an added fatality benefit to your recipient should you pass away as the result of a mishap.

Table of Contents

Latest Posts

Life Insurance Instant Quote

Top Burial Insurance

Selling Funeral Plans

More

Latest Posts

Life Insurance Instant Quote

Top Burial Insurance

Selling Funeral Plans