Featured

Table of Contents

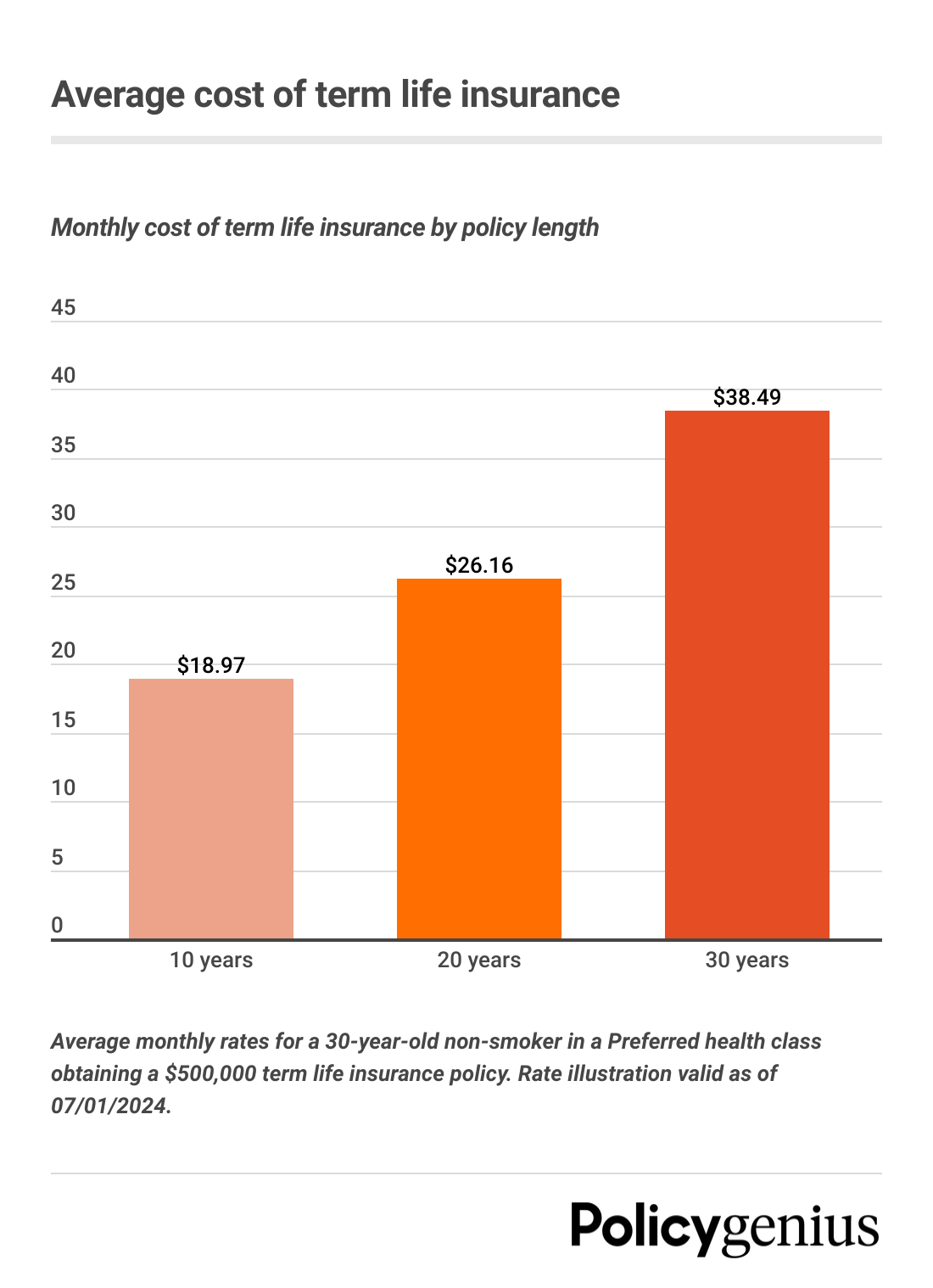

If you select level term life insurance policy, you can allocate your premiums due to the fact that they'll stay the very same throughout your term (Best level term life insurance). Plus, you'll understand specifically just how much of a survivor benefit your recipients will get if you pass away, as this amount won't transform either. The prices for level term life insurance policy will certainly depend upon numerous factors, like your age, health standing, and the insurer you select

Once you go via the application and clinical test, the life insurance policy business will evaluate your application. Upon approval, you can pay your first premium and sign any kind of relevant paperwork to guarantee you're covered.

Aflac's term life insurance is convenient. You can choose a 10, 20, or 30 year term and take pleasure in the added satisfaction you deserve. Functioning with a representative can assist you find a policy that functions best for your needs. Find out more and get a quote today!.

This is despite whether the guaranteed person dies on the day the plan begins or the day prior to the policy finishes. To put it simply, the quantity of cover is 'level'. Legal & General Life Insurance Coverage is an example of a level term life insurance policy plan. A degree term life insurance policy can suit a wide variety of conditions and needs.

What should I look for in a Level Term Life Insurance For Seniors plan?

Your life insurance coverage plan could also form component of your estate, so might be subject to Inheritance Tax reviewed extra regarding life insurance policy and tax obligation. Allow's look at some functions of Life Insurance policy from Legal & General: Minimum age 18 Optimum age 77 (Life insurance policy), or 67 (with Vital Health Problem Cover).

The amount you pay remains the same, but the degree of cover decreases roughly in line with the means a settlement home loan decreases. Lowering life insurance coverage can help your liked ones stay in the household home and avoid any kind of additional interruption if you were to pass away.

Term life insurance gives protection for a particular period of time, or "term" of years. If the insured person dies within the "term" of the policy and the plan is still active (energetic), then the death benefit is paid out to the recipient. This kind of insurance policy typically enables clients to originally buy even more insurance coverage for less money (costs) than various other type of life insurance policy.

How can Level Term Life Insurance Premiums protect my family?

If anybody is relying on your income or if you have responsibilities (debt, home loan, and so on) that would fall to another person to take care of if you were to pass away, after that the solution is, "Yes." Life insurance policy acts as a replacement for earnings. Have you ever before calculated just how much you'll make in your lifetime? Usually, over the course of your working years, the response is normally "a ton of money." The prospective danger of shedding that making power profits you'll require to fund your family's most significant objectives like purchasing a home, spending for your kids' education, decreasing debt, saving for retired life, and so on.

One of the primary charms of term life insurance policy is that you can get even more coverage for less money. The insurance coverage expires at the end of the policy's term. An additional method term policies differ from entire life or irreversible insurance is that they typically do not construct cash money value in time.

The theory behind lowering the payment later on in life is that the insured anticipates having lowered protection demands. You (hopefully) will owe much less on your mortgage and other financial debts at age 50 than you would at age 30. Consequently, you may choose to pay a lower costs and reduced the amount your recipient would certainly receive, due to the fact that they would not have as much financial obligation to pay on your behalf.

Who provides the best Level Term Life Insurance Calculator?

Our policies are created to fill in the spaces left by SGLI and VGLI plans. AAFMAA functions to comprehend and support your distinct monetary objectives at every stage of life, customizing our service to your distinct scenario. online or over the phone with one of our military life insurance policy specialists at and discover more about your military and today.

With this kind of coverage, costs are therefore ensured to continue to be the exact same throughout the agreement., the quantity of protection provided rises over time.

Term plans are also commonly level-premium, however the overage amount will stay the exact same and not expand. The most common terms are 10, 15, 20, and thirty years, based on the requirements of the insurance holder. Level-premium insurance is a kind of life insurance in which costs remain the same rate throughout the term, while the amount of coverage provided boosts.

For a term plan, this suggests for the size of the term (e.g. 20 or 30 years); and for a long-term policy, until the insured passes away. Over the long run, level-premium payments are typically a lot more cost-efficient.

How do I choose the right Best Value Level Term Life Insurance?

They each look for a 30-year term with $1 million in protection. Jen purchases an assured level-premium policy at around $42 monthly, with a 30-year horizon, for a total amount of $500 each year. But Beth numbers she may just require a prepare for three-to-five years or till complete repayment of her current debts.

In year 1, she pays $240 per year, 1 and around $500 by year 5. In years two with 5, Jen proceeds to pay $500 each month, and Beth has actually paid approximately just $357 annually for the exact same $1 numerous protection. If Beth no longer requires life insurance coverage at year five, she will certainly have saved a whole lot of money about what Jen paid.

Every year as Beth grows older, she encounters ever-higher yearly premiums. Jen will certainly proceed to pay $500 per year. Life insurance firms have the ability to offer level-premium plans by essentially "over-charging" for the earlier years of the plan, gathering more than what is needed actuarially to cover the risk of the insured dying throughout that early duration.

1 Life Insurance Policy Stats, Information And Industry Trends 2024. 2 Price of insurance coverage prices are determined utilizing methods that vary by business. These prices can differ and will generally boost with age. Rates for active staff members might be various than those readily available to terminated or retired staff members. It is very important to check out all variables when examining the general competitiveness of prices and the value of life insurance protection.

What types of Level Term Life Insurance Coverage are available?

Nothing in these materials is intended to be guidance for a specific circumstance or person. Please talk to your own consultants for such guidance - Low cost level term life insurance. Like many team insurance plan, insurance plans offered by MetLife contain specific exemptions, exceptions, waiting durations, decreases, limitations and terms for maintaining them in pressure. Please call your advantages administrator or MetLife for prices and complete information.

Latest Posts

Life Insurance Instant Quote

Top Burial Insurance

Selling Funeral Plans