Featured

Table of Contents

Insurer will not pay a minor. Instead, think about leaving the cash to an estate or trust. For even more in-depth details on life insurance policy obtain a copy of the NAIC Life Insurance Coverage Purchasers Guide.

The internal revenue service places a limit on just how much cash can enter into life insurance premiums for the plan and how rapidly such costs can be paid in order for the policy to retain every one of its tax advantages. If particular restrictions are gone beyond, a MEC results. MEC insurance policy holders may go through taxes on distributions on an income-first basis, that is, to the level there is gain in their policies, along with fines on any type of taxable amount if they are not age 59 1/2 or older.

Please note that outstanding loans accumulate passion. Earnings tax-free therapy likewise assumes the finance will at some point be pleased from income tax-free death benefit earnings. Finances and withdrawals reduce the policy's cash money worth and survivor benefit, might trigger particular policy advantages or bikers to become inaccessible and might increase the opportunity the plan might lapse.

4 This is provided through a Lasting Care Servicessm motorcyclist, which is available for an added cost. Furthermore, there are restrictions and limitations. A customer might get approved for the life insurance policy, however not the motorcyclist. It is paid as a velocity of the death benefit. A variable global life insurance policy contract is an agreement with the key objective of giving a death advantage.

How long does Accidental Death coverage last?

These profiles are closely handled in order to please stated financial investment purposes. There are costs and fees connected with variable life insurance policy agreements, including death and risk charges, a front-end load, management charges, investment management charges, abandonment charges and fees for optional bikers. Equitable Financial and its affiliates do not supply legal or tax recommendations.

And that's excellent, since that's specifically what the fatality advantage is for.

What are the benefits of entire life insurance coverage? Below are a few of the essential things you ought to understand. One of the most attractive benefits of acquiring a whole life insurance policy policy is this: As long as you pay your premiums, your survivor benefit will certainly never ever end. It is assured to be paid no matter of when you pass away, whether that's tomorrow, in five years, 80 years or even further away. Long term care.

Assume you do not need life insurance if you do not have youngsters? There are numerous benefits to having life insurance, also if you're not sustaining a family.

Who has the best customer service for Policyholders?

Funeral costs, burial expenses and medical costs can accumulate (Income protection). The last point you desire is for your liked ones to bear this added worry. Irreversible life insurance policy is offered in numerous amounts, so you can choose a survivor benefit that fulfills your demands. Alright, this one just uses if you have youngsters.

Figure out whether term or irreversible life insurance coverage is best for you. As your personal scenarios adjustment (i.e., marriage, birth of a kid or task promotion), so will your life insurance coverage requires.

For the a lot of component, there are two sorts of life insurance policy prepares - either term or long-term strategies or some combination of both. Life insurance providers use different kinds of term plans and conventional life policies as well as "interest sensitive" items which have ended up being extra widespread given that the 1980's.

Term insurance policy gives protection for a specific time period. This period can be as brief as one year or offer insurance coverage for a particular number of years such as 5, 10, 20 years or to a defined age such as 80 or in many cases up to the earliest age in the life insurance coverage mortality.

Where can I find Trust Planning?

Presently term insurance coverage rates are really competitive and among the cheapest historically knowledgeable. It ought to be kept in mind that it is an extensively held belief that term insurance policy is the least expensive pure life insurance coverage readily available. One needs to assess the plan terms meticulously to decide which term life choices are ideal to meet your certain circumstances.

With each brand-new term the premium is increased. The right to restore the policy without evidence of insurability is an essential advantage to you. Otherwise, the risk you take is that your health and wellness may weaken and you may be unable to get a plan at the same rates and even whatsoever, leaving you and your beneficiaries without coverage.

You should exercise this choice throughout the conversion duration. The size of the conversion period will certainly vary depending upon the sort of term plan acquired. If you transform within the proposed period, you are not called for to provide any info about your health and wellness. The premium price you pay on conversion is normally based upon your "current attained age", which is your age on the conversion date.

Under a level term policy the face quantity of the plan remains the same for the entire duration. Often such plans are sold as home loan defense with the amount of insurance decreasing as the equilibrium of the mortgage reduces.

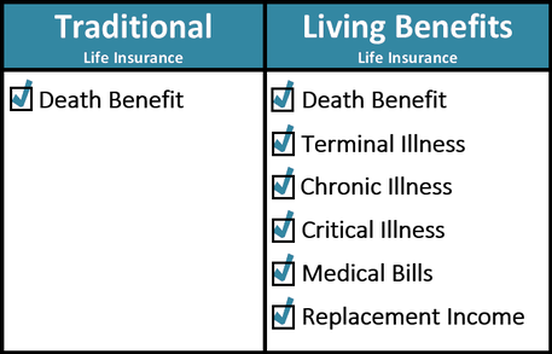

How does Living Benefits work?

Commonly, insurers have actually not can alter costs after the plan is offered. Given that such plans may proceed for lots of years, insurance firms should use conventional mortality, interest and expenditure rate price quotes in the costs calculation. Adjustable costs insurance, nevertheless, permits insurers to use insurance coverage at lower "present" premiums based upon less conventional assumptions with the right to transform these premiums in the future.

While term insurance policy is created to supply defense for a defined time duration, irreversible insurance policy is made to give protection for your whole lifetime. To maintain the premium rate level, the premium at the younger ages goes beyond the real cost of defense. This added premium builds a book (cash money value) which aids spend for the plan in later years as the cost of security surges over the premium.

The insurance company invests the excess premium bucks This kind of plan, which is occasionally called cash money worth life insurance coverage, creates a cost savings element. Cash values are essential to a permanent life insurance coverage policy.

Table of Contents

Latest Posts

Life Insurance Instant Quote

Top Burial Insurance

Selling Funeral Plans

More

Latest Posts

Life Insurance Instant Quote

Top Burial Insurance

Selling Funeral Plans