Featured

Table of Contents

The long-lasting care biker is a type of accelerated fatality benefit that can be made use of to pay for nursing-home, assisted-living, or in-home care when the insured calls for aid with tasks of day-to-day living, such as bathing, consuming, and using the bathroom. A ensured insurability biker lets the insurance holder get added insurance at a later day without a medical review. This opportunity can come with high charges and a reduced death advantage, so it may just be a good option for people that have maxed out other tax-advantaged financial savings and financial investment accounts. The pension plan maximization method described earlier is one more method life insurance coverage can fund retired life.

Insurers examine each life insurance policy candidate on a case-by-case basis. In 2023 there were more than 900 life insurance and health and wellness companies in the United States, according to the Insurance policy Details Institute.

Life insurance fatality advantages can assist recipients pay off a mortgage, cover university tuition, or assistance fund retired life. Long-term life insurance policy also includes a cash worth part that builds over time.

Life insurance policy survivor benefit are paid as a lump amount and are exempt to government earnings tax obligation since they are not taken into consideration revenue for beneficiaries. Dependents don't need to bother with living costs - Income protection. Many plan calculators recommend a numerous of your gross earnings equivalent to 7 to 10 years that can cover major expenditures such as mortgages and university tuition without the enduring spouse or children needing to get loans

Why should I have Final Expense?

As soon as you determine what kind of insurance policy you need and just how much protection makes feeling for your situation, contrast items from top life insurance policy companies to figure out the most effective fit.

Active worker should be full-time (normal status, 80% or higher) or part-time (routine status, 40%-79%) - Life insurance plans. If you choose reliant and/or spouse/qualifying adult protection, you will be needed to complete a Declaration of Health and wellness. The Supplemental Life section of the strategy gives added defense for those who depend on you economically

Advantage options are readily available in different increments with the minimal benefit quantity as $20,000 and the optimum advantage quantity as $500,000. If you are currently registered in Supplemental Life, you might increase your protection by one degree without a Statement of Wellness. Any added degree of protection will certainly need a Statement of Health and wellness.

No individual may be insured as a Dependent of more than one employee. For your youngster to be qualified for coverage, your child should: Be 2 week to 1 year old for $500 or 1 year old as much as 26 years for $10,000 (over 26 years may be proceeded if the Reliant Youngster fulfills the Disabled Child needs) No individual can be insured as a dependent of greater than one worker If you come to be terminally ill as a result of an injury or sickness, you or your lawful rep have the choice to request an ABO.

Flexible Premiums

The taxable price of this team term life insurance is computed on the basis of consistent premium prices figured out by the Internal Profits Service based upon the staff member's age. MetLife chose AXA Support USA, Inc. to be the manager for Traveling Support solutions. This solution aids interfere in clinical emergency situations in international nations.

Nevertheless, you will certainly owe tax obligations if any type of part of the amount you withdraw is from passion, returns or funding gains. Be conscious that the amount you take out will be subtracted from the policy's fatality advantage if it's not paid back. You'll be charged rate of interest if you secure a finance against your permanent life policy, yet it's typically lower than the passion charged by various other lenders.

Who provides the best Guaranteed Benefits?

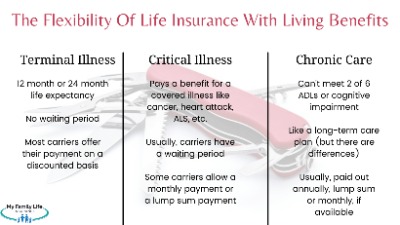

It's a valuable living benefit to have when you take into consideration that 70 percent of people transforming 65 today will certainly require some form of long-term treatment in their lives.

Right here's just how: is a type of long-term life insurance (as is global and variable life). Irreversible life insurance policy policies will certainly enable you to accessibility of your account while you're to life.

And you will not have prompt accessibility to cash once the plan goes live. You'll require a sufficient money quantity in the account before you can use it (and it requires time to build that up).Get a totally free rate quote now. Assuming you have a policy that has a money component to it, you can then surrender it and withdraw the whole present money worth.

Still, this may be a much better alternative than utilizing a or taking a because you will not have your credit rating inspected in order to get the funds. You'll possibly have much better repayment terms, also. It's a popular that you can't utilize your life insurance coverage while alive. Not only can you possibly utilize it, but it may likewise be a much better lorry than various other kinds of credit rating.

Can I get Living Benefits online?

If you want the benefits this option can pay for then start by getting a free estimate. Matt Richardson is the managing editor for the Managing Your Cash area for He creates and modifies content concerning personal finance ranging from savings to investing to insurance policy.

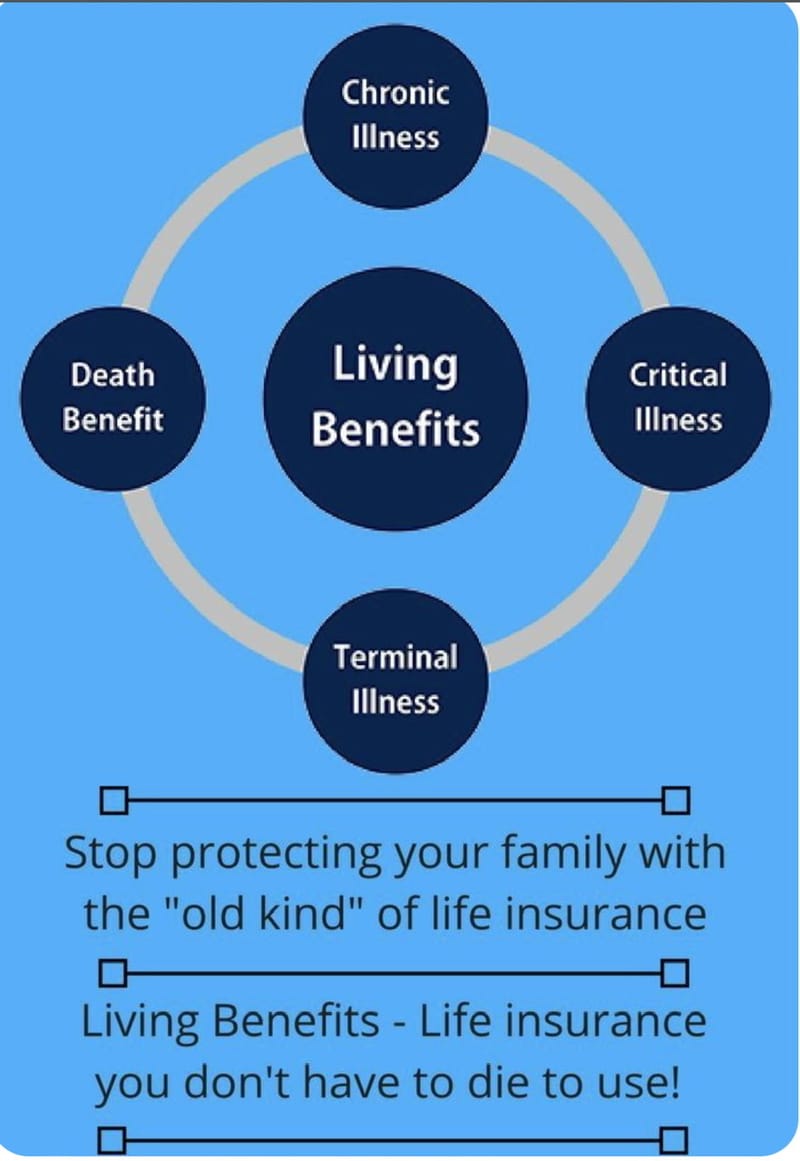

Life Insurance with living benefit riders supplies monetary defense throughout significant life occasions or health issues. These riders can be included in long-term and term life insurance policy plans, yet the terms differ. Kinds of living advantage cyclists consist of Accelerated Fatality Advantage, Critical Ailment, Persistent Health Problem, Long-Term Care, and a lot more. Accessing living benefits may reduce the final death benefit to beneficiaries, demanding a comprehensive understanding prior to usage.

At its core, life insurance policy is created to provide economic protection to your enjoyed ones in the occasion of your death. Traditional life insurance (Wealth transfer plans) protection provides a fatality advantage to recipients when the insured private die. Nevertheless, as the needs and needs of customers have actually advanced, so have life insurance products.

Table of Contents

Latest Posts

Life Insurance Instant Quote

Top Burial Insurance

Selling Funeral Plans

More

Latest Posts

Life Insurance Instant Quote

Top Burial Insurance

Selling Funeral Plans